Financing peruvian progress

This is how we facilitated access to working capital for microentrepreneurs.

My Role

I worked with a researcher and two strategic design directors who advised us throughout the project. I participated conducting research sessions and provided the methodology for synthesizing the results. I was responsible for brand identity, visual design and the final user interfaces.

The Challenge

A financing company, part of one the largest economic groups in Peru, came to us with a request: they wanted to play a relevant role in facilitating access to working capital for microentrepreneurs. Our solution must consider two characteristics: 1. Be digital, and 2. Leverage on the group's retails.

The Process

Once the challenge was set, our first step was to create a proto-concept for the microfinancing service based on the company’s internal knowledge and our own inputs. We had a kick-off meeting with the client and originally set the project plan for 7 weeks, but then adjusted it to 12 weeks.

Stage 1: Build it

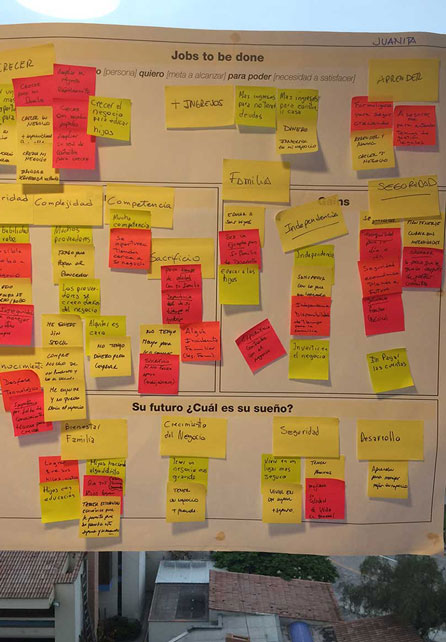

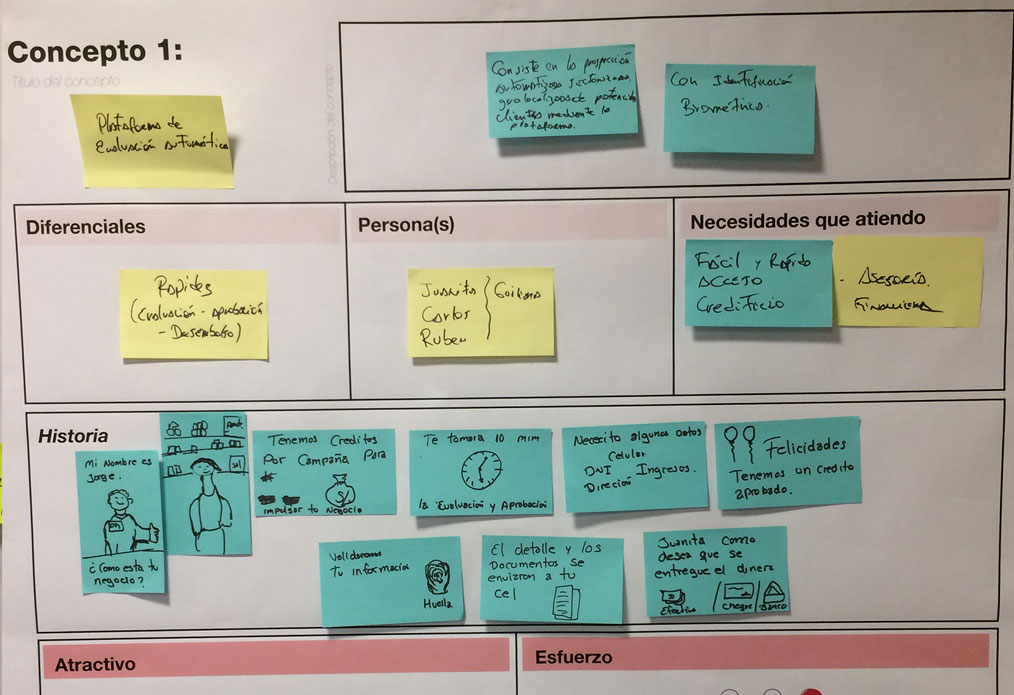

We started digging in with desk research and reviewing the client’s data and previous research results. After gathering all that info, we defined four personas, mostly considering their relationship with technology and financial behaviour. With those four in mind, we hosted a co-creation workshop to collectively develop 4 different concepts to address the personas financial needs. This first proto-concept was meant to be a solution for the four of them.

We also held a Naming workshop and used its results for the proto-concept. Crezco, a digital benefits program for microentrepreneurs, was born.

State 2: Contrast it

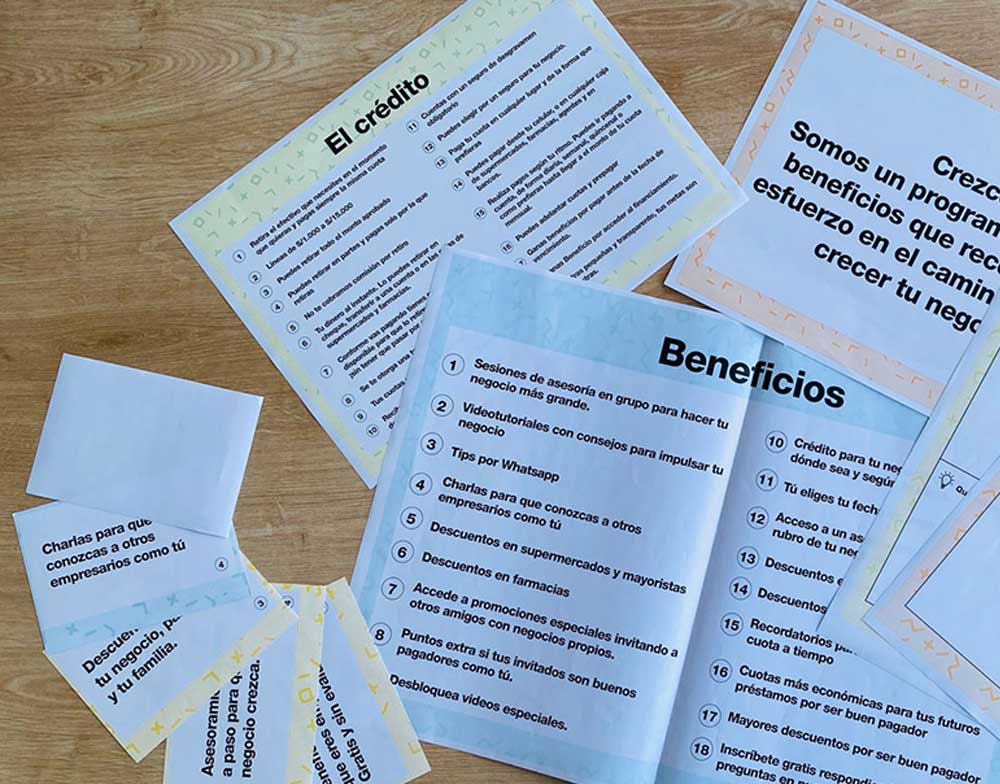

Our solution recognized the potential in microentrepreneurs by walking them through the process of growing their business with assessment, discounts and adaptable credit for customers. Or so we wanted to be sure of.

We took the value proposition and product features to microentrepreneurs to identify their perception and find out which benefits hold more value for them. We first conducted eleven triads inviting microentrepreneurs with different financial behaviours, analyzed their inputs, iterated on results, and then conducted six contextual interviews to validate and contrast.

Providing acknowledgement and access to growth presented us as an ally that was empathetic with our users daily efforts. Advisory was the most valued benefit, even over discounts, that were seen as an important way to save money to reinvest in their business.

Stage 3: Design it

After deciding on our final concept, we started building the Crezco brand. We delivered a Business Canvas and a detailed Customer Journey Map to make the commercial offering and service clear to our client. These deliverables were extremely important because they would lead our client once our time with them was over.

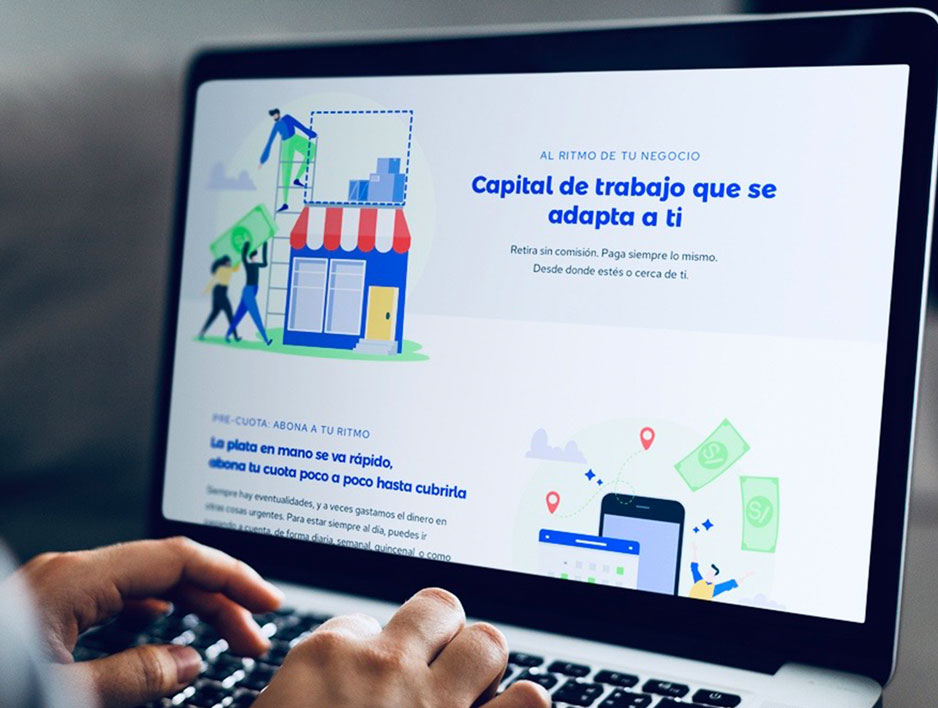

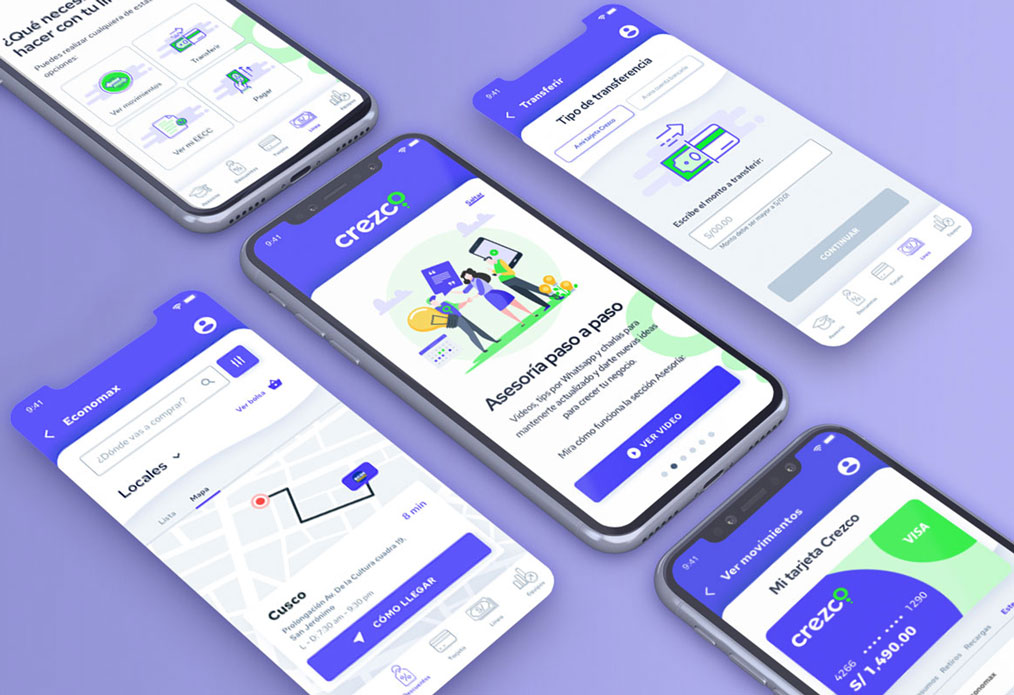

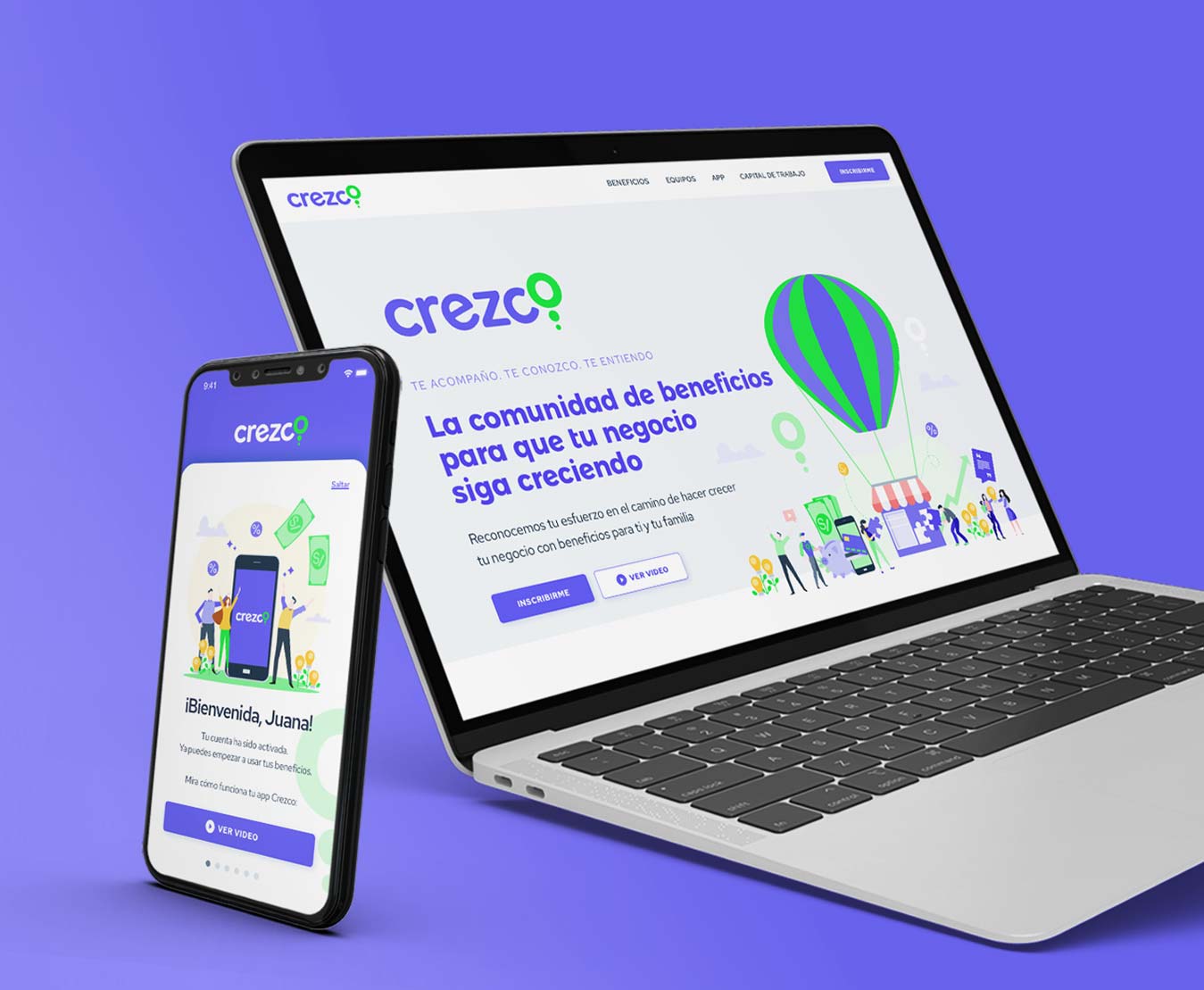

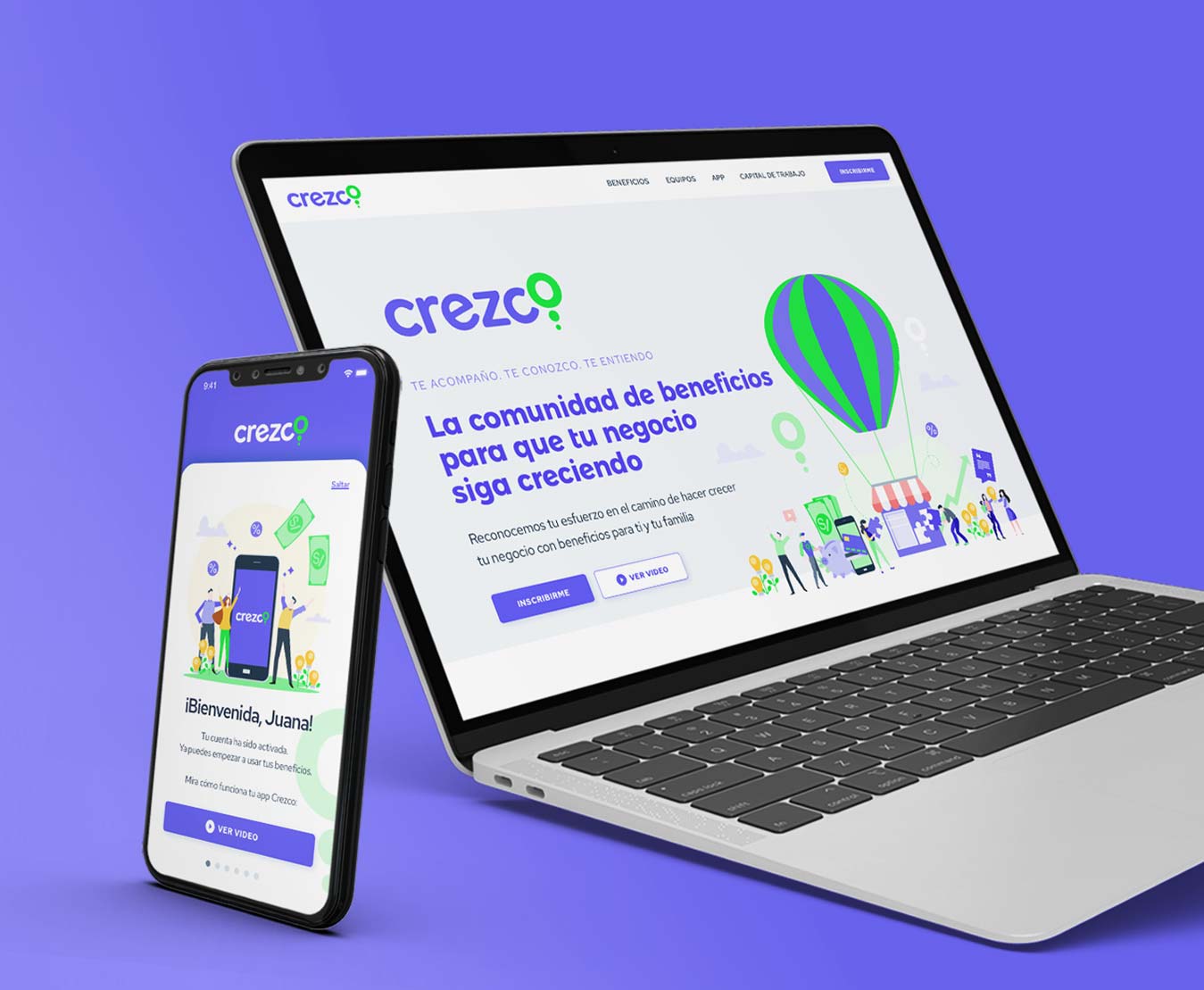

Then we focused on defining brand personality and values to work on the visual identity for Crezco. The final artifacts to be designed were a website (to explain our value proposition and features to end-users) and a mobile app (to access the program benefits and become a powerful tool for users to be in control of their credit).

Reflections

On one side, working on this project gave me the opportunity to learn from two wonderful strategic design directors whom I admire and feel grateful for working with. On another side, our solution promoted a healthy financial behaviour as a result of advisory, discounts and easy access to adaptable credit, not just access to money. So in the end, it helped people beyond financing, and I'm proud of what we achieved.